How to Calculate Cost of Sales Using Gross Profit Margin

How to Calculate Cost of Sales Using Gross Profit Margin

Gross profit percentage is the formula which is used by the management, investors and financial analysts to know the financial health and profitability of the company after accounting for the cost of sales and is calculated by dividing the gross profit of the company by its net sales.

What is the Gross Profit Percentage?

Gross Profit Percentage is a measure of profitability that calculates how much of every dollar of revenue is left over after paying off the cost of goods sold (COGS). In other words, it measures the efficiency of a company in utilizing its input costs of production, such as raw materials and labor, in order to produce and sell its products profitably.

It can be seen as the percentage of sales that exceeds the direct costs associated with manufacturing the product. These direct costs Direct costs are costs incurred by an organization while performing its core business activity and can be attributed directly in the production cost, such as raw material costs, wages paid to factory staff, power & fuel expenses in a factory, and so on, but do not include indirect costs such as advertisement costs, administrative costs, etc. read more or COGS The cost of goods sold (COGS) is the cumulative total of direct costs incurred for the goods or services sold, including direct expenses like raw material, direct labour cost and other direct costs. However, it excludes all the indirect expenses incurred by the company. read more primarily consist of raw materials and direct labor. Calculation of the gross profit percentage formula The profit percentage formula calculates the financial benefits left with the entity after it has paid all the expenses. Profit percentage is of two types - markup expressed as a percentage of cost price or profit margin calculated using the selling price. read more is done by dividing the gross profit by the total sales and expressed in percentage terms.

Gross Profit Margin Formula

The gross profit percentage formula is represented as,

Gross profit percentage formula = Gross profit / Total sales * 100%

You are free to use this image on your website, templates etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Gross Profit Percentage (wallstreetmojo.com)

It can be further expanded as,

Gross profit percentage formula = (Total sales – Cost of goods sold) / Total sales * 100%

The money that is remaining after covering the COGS is used to service other operating expenses like selling/commission expense, general & administrative expenses Administrative expenses are indirect costs incurred by a business that are not directly related to the manufacturing, production, or sale of goods or services provided, but are necessary for the smooth functioning of business operations, such as information technology, finance & accounts. read more , research & development, marketing expense, and interest expense that appear further below in the income statement. As such, the higher it is, the better it is for a company to pay off the operating expenses of the business.

Steps to Determine Gross Profit Percentage

The calculation of gross profit percentage formula can be simply done by using the following steps:

- Firstly, note the total sales of the company, which is easily available as a line item in the income statement.

- Next, either gather the COGS directly from the income statement or compute the COGS by adding the direct costs of manufacturing, such as raw materials, labor wages, etc.

- Next, the gross profit is calculated by deducting the COGS from the total sales.

Gross profit = Total sales – COGS; - Finally, it is calculated by dividing the gross profit Gross Profit shows the earnings of the business entity from its core business activity i.e. the profit of the company that is arrived after deducting all the direct expenses like raw material cost, labor cost, etc. from the direct income generated from the sale of its goods and services. read more by the total sales, as shown below. It is expressed in percentage, as the name suggests.

Gross profit percentage formula = (Total sales – Cost of goods sold) / Total sales * 100%

Gross Profit Percentage Examples

Let's understand the concept with the help of a simple example to understand it better.

Example #1

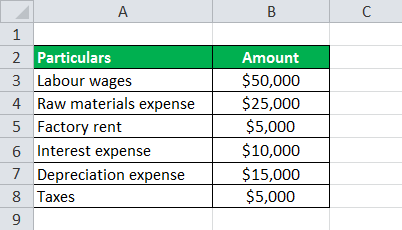

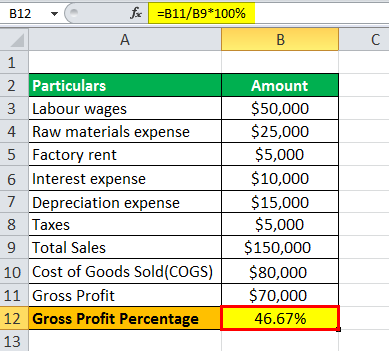

Let us consider an example of a company called XYZ Limited for doing the calculation of gross profit. XYZ Limited is in the business of manufacturing customized roller skates for both professional and amateur skaters. At the end of the financial year, XYZ Limited has earned $150,000 in total net sales along with the following expenses.

As per the question, Based on the below information, we will do the calculation of the gross profit percentage for XYZ Limited.

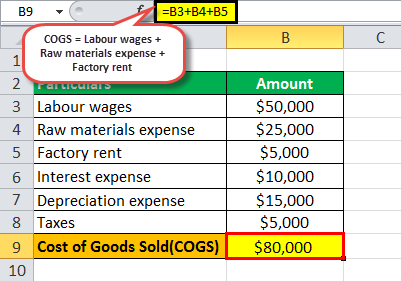

By using the above data, we will first calculate the Cost of Goods Sold(COGS)

- COGS = Labour wages + Raw materials expense + Factory rent

- = $50,000 + $25,000 + $5,000

COGS= $80,000

[Only those costs are taken in the computation of COGS which can be directly allocated to the production]

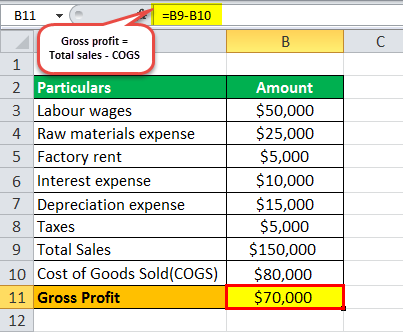

Now, we will calculate the Gross Profit by using data given,

- Gross profit = Total sales – COGS

- = $150,000 – $80,000

Gross profit = $70,000

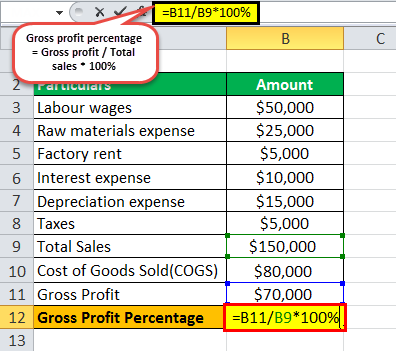

Therefore, the calculation of gross profit percentage for XYZ Limited will be

- Gross profit percentage formula = Gross profit / Total sales * 100%

- = $70,000 / $150,000 * 100%

XYZ Limited's GPP for the year is as follows

XYZ Limited's gross profit % for the year stood at 46.67%.

Example 2

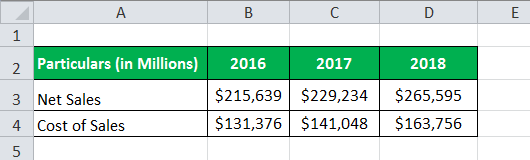

Let us take the example of Apple Inc. For the gross profit percentage calculation for the fiscal year Fiscal Year (FY) is referred to as a period lasting for twelve months and is used for budgeting, account keeping and all the other financial reporting for industries. Some of the most commonly used Fiscal Years by businesses all over the world are: 1st January to 31st December, 1st April to 31st March, 1st July to 30th June and 1st October to 30th September read more 2016, 2017, and 2018.

As per the annual reports An annual report is a document that a corporation publishes for its internal and external stakeholders to describe the company's performance, financial information, and disclosures related to its operations. Over time, these reports have become legal and regulatory requirements. read more , the following information is available:

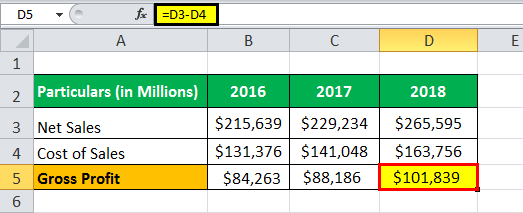

Based on the below information, we will do the calculation of Apple Inc. for the years 2016, 2017, and 2018.

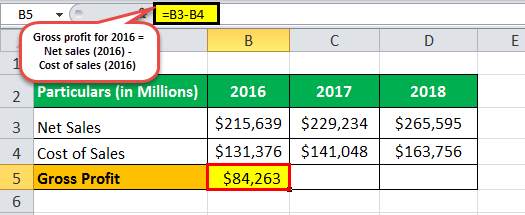

By using the above data, we will first calculate the gross profit Gross profit formula is calculated by subtracting the cost of goods sold from the net sales where Net Sales is calculated by subtracting all the sales returns, discounts and the allowances from the Gross Sales and the Cost Of Goods Sold (COGS) is calculated by subtracting the closing stock from the sum of opening stock and the Purchases Made During the Period. read more of Apple Inc. for the year 2016,

- Gross profit for 2016 = Net sales (2016) – Cost of sales The costs directly attributable to the production of the goods that are sold in the firm or organization are referred to as the cost of sales. read more (2016)

- = $215,639 – $131,376

- Gross profit for 2016 = $84,263

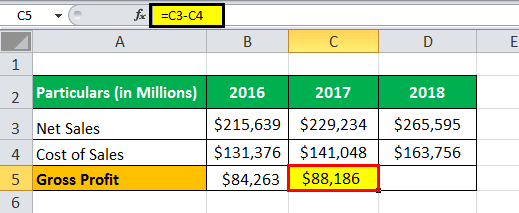

- Gross profit for 2017 = $229,234 – $141,048

- Gross profit for 2017= $88,186

- Gross profit for 2018 = $265,595 – $163,756

Gross profit for 2018= $101,839

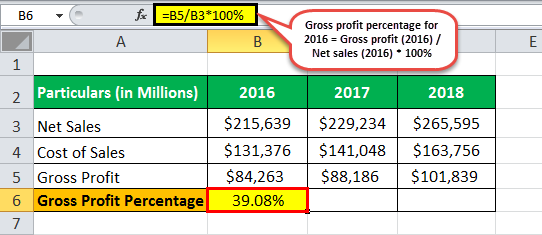

Now we will, do the calculation of gross profit % of Apple Inc. for the year 2016

- GPP for 2016 = Gross profit (2016) / Net sales (2016) * 100%

- = $84,263 / $215,639 * 100%

GPP for 2016= 39.08%

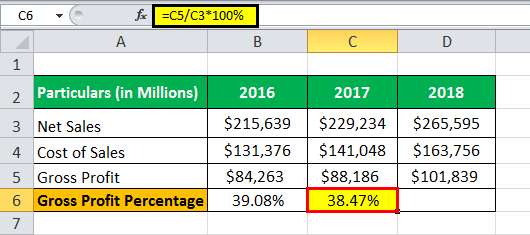

Therefore, the calculation of the gross profit % of Apple Inc. for the year 2017 will be

- GPP for 2017 = $88,186 / $229,234 * 100%

GPP for 2017= 38.47%

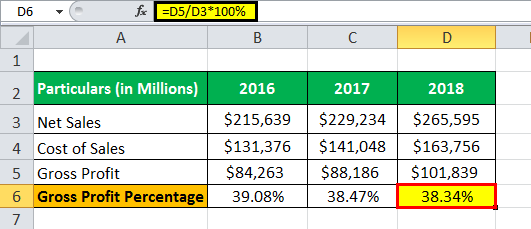

Therefore, calculation of Gross profit % of Apple Inc. for the year 2018 will be

- GPP for 2018 = $101,839 / $265,595 * 100%

GPP for 2018 = 38.34%

Therefore, the calculation of the gross profit percentage of Apple Inc. for 2016, 2017 and 2018 stood at 39.08%, 38.47% and 38.34% respectively.

Relevance and Uses

- The understanding of it is very important for an investor because it shows how profitable is the core business activities of the company without taking into consideration the indirect costs Indirect cost is the cost that cannot be directly attributed to the production. These are the necessary expenditures and can be fixed or variable in nature like the office expenses, administration, sales promotion expense, etc. read more . An analyst can use this ratio, especially as an assessment metric to compare the operating performance of a company with other players within the same industry and sector. Also, companies use this ratio as an indication of the financial benefit and viability of a particular product or service.

- Any money that is left after covering the COGS is used to pay off other operating expenses. In simple words, the higher it is, the more the company saves on each dollar of sales to service its other operating costs and business obligations.

- If a company is capable of sustaining materially higher gross profit margins compared to most of its peers always, then it means that it has more efficient processes and more efficient operations that makes it a safe long term investment Long Term Investments are financial instruments such as stocks, bonds, cash, or real estate assets that a company intends to hold for more than 365 days in order to maximize profits and are reported on the asset side of the balance sheet under the heading non-current assets. read more .

- On the other hand, if a company is not able to earn an adequate gross profit percentage, then it may be difficult for such a company to pay for its operating expenses Operating expense (OPEX) is the cost incurred in the normal course of business and does not include expenses directly related to product manufacturing or service delivery. Therefore, they are readily available in the income statement and help to determine the net profit. read more . As such, the gross profit percentage of a company should be stable unless and until there are some major changes done to the company's business model.

Gross Profit Percentage Video

Recommended Articles

This has been a guide to what is Gross Profit Percentage and its definition. Here we calculate gross profit percentage using its formula along with practical examples. You may learn more about our articles below on accounting –

- Formula of Markup Percentage

- Decrease Percentage of Formula

- Gross Profit Margin Formula Calculation

- Net Profit Margin Formula

Source: https://www.wallstreetmojo.com/gross-profit-percentage/

Posted by: ashpaligar.blogspot.com

0 Response to "How to Calculate Cost of Sales Using Gross Profit Margin"

Post a Comment